https://youtu.be/wRb2qK0RkDU There is no set definition about what is considered pre-qualified and what is…

2-1 Buydown – A Temporary Buydown to Help Get your Payment Lower the First Two Years | Omaha NE Homebuyer’s Guide

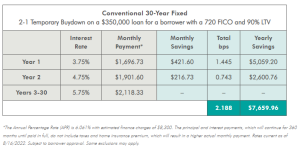

HELPING BUYERS LOWER THEIR INTEREST RATE BY UP TO 2% AT THE START OF THEIR LOAN

Give your clients extra flexibility with a lower monthly payment by offering them a Temporary Rate Buydown to lower their interest rate at the start of their loan. It’s a great option for borrowers who expect an increase in their income in the next few years or who have excess seller concessions to use — and want to take advantage of a low fixed rate.

I am a local mortgage broker serving Omaha, Papillion, Bellevue, La Vista, and all of eastern Nebraska. If you need help finding a local realtor or qualifying for a home loan please contact me.

Available for:

Conventional primary and second home purchases

FHA and VA primary home purchases

Seller-paid 1- and 2-year buydown options

2-1 buydown of 2% in the first year and 1% in the second year. By the third year, they are at the full rate.

1-0 buydown of 1% in the first year. By the second year, they are at the full rate.

See an example of the potential savings on a 2-1 temporary buydown:

The borrower must qualify for the full monthly payment (before the buydown rate is applied)

Seller concessions are deposited as a lump sum into a buydown account. A portion of this sum is released each month to reduce the borrower’s monthly payments.

Other useful links

- How to improve your credit

- The 20% down rule on conventional

- What is Escrow?

- How is income calculated?

- Why your assets matter

- Mortgage Calculator

- Is Credit Karma accurate?

- FHA vs Conventional, which is better?