Most people think selling their home over the holidays is a bad idea. The house…

Is the credit score on Credit Karma accurate?

This is a question I get quite a bit. Is the credit score on Credit Karma accurate? The short answer is “no”, but that does not mean that Credit Karma and other free credit monitoring services do not serve a purpose. Below I will go over why they are not quite accurate and how you can still use them to help you get into a home.

*Purchasing a home is unique for every buyer because every buyer’s financial situation is unique. We firmly believe that speaking with a local mortgage lender is the best way to finance your home. If you are in Omaha, Papillion, or any of the surrounding areas in Nebraska we can set up a face-to-face, phone call, or video conference to walk you through the home buying process.

Why is Credit Karma inaccurate?

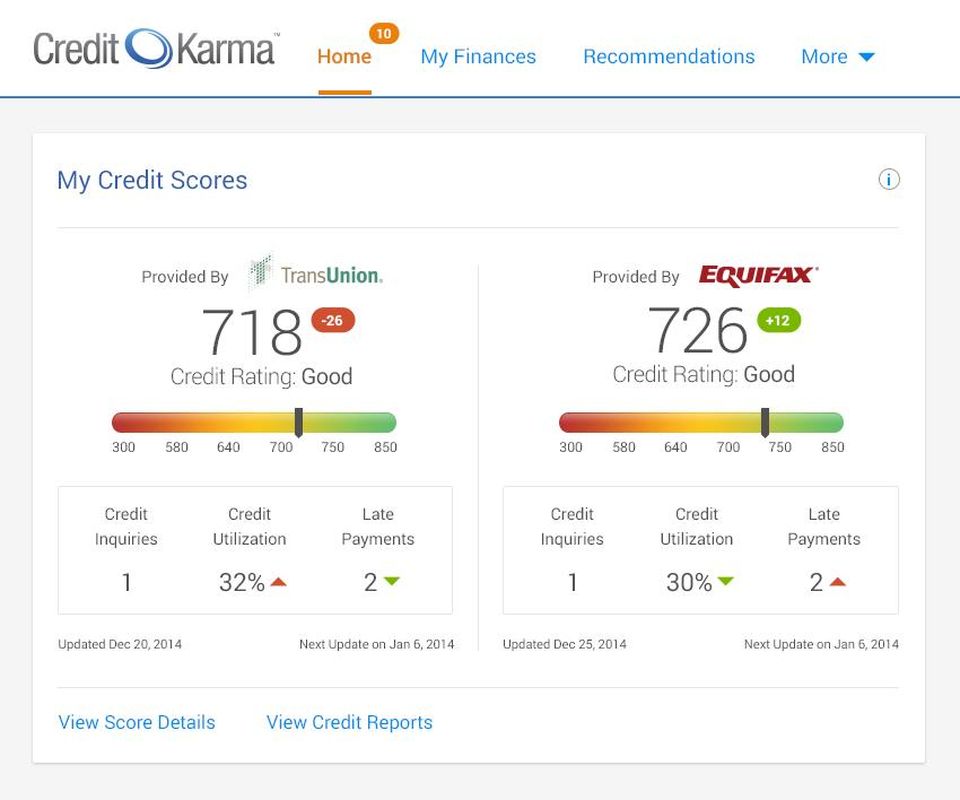

There are two big reasons the scores on Credit Karma and your actual scores will vary. First Credit Karma is not actually pulling your credit scores. They are using Vantage Credit (similar to FICO) to take impressions of your credit. Your actual credit scores will come from Trans Union, Equifax, and Experian. Vantage and FICO are systems that look at the data from these credit bureaus to estimate your credit scores.

The second reason the scores are different is there are many different credit reports. Credit cards, auto loans, and mortgage lenders pull their own type of credit report from Trans Union, Equifax, and Experian. Depending on what type of debt you are taking out, your scores will be different.

How inaccurate is Credit Karma?

First the bad news, Credit Karma and other free credit sites typically estimate your score too high. If a buyer comes in and gives me their Credit Karma score I can usually expect the actual scores to be 20 or 30 points lower on the full report. How inaccurate it is typically depends on the amount of credit history you have. If you have a short credit history or a limited number of tradelines (active debts) it is harder for Credit Karma to accurately estimate your score.

How can I use Credit Karma to get a home loan?

Credit Karma is an excellent credit monitoring service. I will tell clients to pay less attention to the score Credit Karma is giving you and focus on the direction the scores are going. If improvements are needed we will give clients a plan of action. That plan includes signing up for Credit Karma’s monitoring service to make sure they are headed in the right direction.

Whether you use a free credit service or not, contact a local lender as soon as possible.

We are a bit bias on this point, but the best way to prepare to buy a home is to first talk with a local lender. Credit Karma is a great tool, but you need a local professional to guide you through the process. Besides having a bit of expertise in knowing what will improve your credit scores and history, we have contacts that can council you if needed or help you remove incorrect items from your report. The amount of money you will save in upfront cost and monthly interest with a great credit score will be worth the time and effort needed to get your scores up.

Is the credit score on Credit Karma accurate? No, but it can be a great tool for you and your local mortgage lender.

Then contact us to create a plan of action.