https://youtu.be/wRb2qK0RkDU There is no set definition about what is considered pre-qualified and what is…

Nebraska Mortgage Rates | May 21 2021

Weekly Rate Update

Rates fluctuate everyday and are based on several factors. For an exact rate quote, submit your request HERE for a free evaluation.

PMMS 5/20/2021

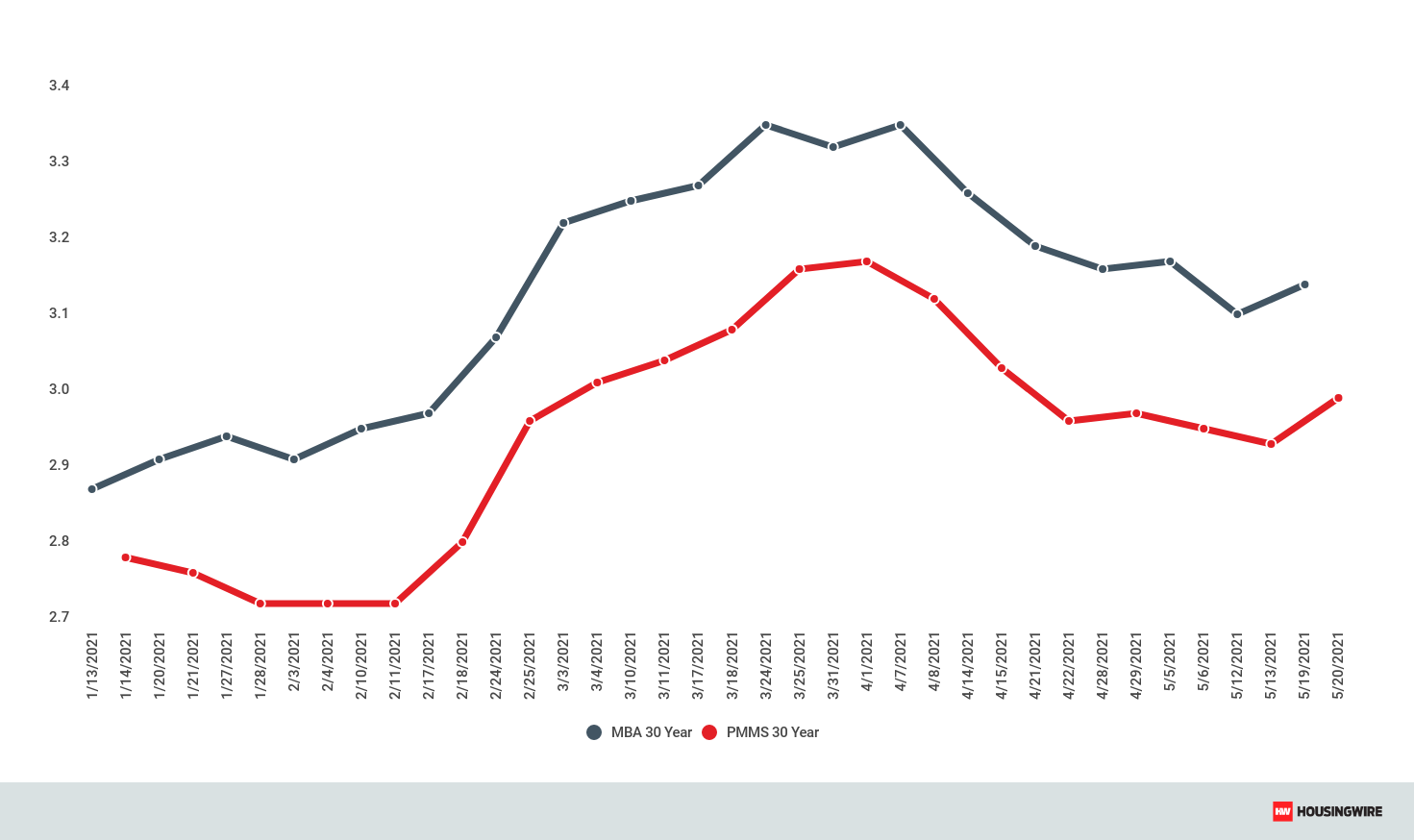

After hovering below 3% for a month, the average 30-year fixed mortgage rate popped back up six basis points to exactly 3% last week.

Mortgage rates climbed north of 3% over the first few months of 2021, but crested at 3.2% in March before descending again. Despite such a favorable rate climate, there remains a shortage of homes for sale, pointed out Sam Khater, Freddie Mac’s chief economist.

“The lack of housing supply has been compounded by labor disruptions and expensive building materials that are driving up the cost of new housing, making it difficult for homebuyers to find homes to purchase,” Khater said.

Because mortgage rates held for so long in the sub-3% category, Fannie Mae‘s economic and strategic research group revised its expectations for 2021 and 2022 origination volume, noting that originations could have been higher if the market weren’t struggling with supply.

“We downgraded our expectation for 2021 purchase volumes by $43 billion from last month’s forecast to $1.8 trillion,” the ESR group said, “We expect refinance origination volume to be $2.2 trillion in 2021, a $125 billion upward revision from last month’s forecast, as incoming data continue to come in strong and interest rates have pulled back in recent weeks.”

MBA 5/19/2021

Mortgage applications increased for the second straight week, this time jumping 1.2% for the week ending May 14, 2021. All loan types hit their highest levels in two weeks.

Mortgage rates were still lower than levels reported in late March and early April, providing additional opportunity for borrowers to refinance, said Joel Kan, MBA associate vice president of economic and industry forecasting.

“Ongoing volatility in refinance applications is likely if rates continue to oscillate around current levels,” Kan said. “There continues to be strong demand for buying a home, but persistent supply shortages are constraining purchase activity, and building material shortages and higher costs are making it more difficult to increase supply. As a result, home prices and average purchase loan balances continue to rise, with the average purchase application reaching $411,400 — the highest since February.”

Per the National Association of Home Builders, lumber prices have tripled over the past 12 months and have caused the price of an average new single-family home to increase by $35,872 — up from the NAHB’s calculated $24,000 extra HousingWire reported back in February. Other building material prices have been steadily rising as well, said Chuck Fowke, NAHB chairman, who added that the trade organization has been “monitoring” the situation.

Other useful links

- How to improve your credit

- The 20% down rule on conventional

- What is Escrow?

- How is income calculated?

- Why your assets matter

- Mortgage Calculator

- Is Credit Karma accurate?

- FHA vs Conventional, which is better?

What To Do Next